State of DisUnion 2030

and the rise of the common wealth

This is in response to Kathleen Devanney, who called for authors to write their own Citizen SOTU. Here is her own excellent preamble, followed by my SOTU for 2030:

Looking back, no one could say exactly what caused the shift in 2025. Certainly the election had been theater—although many didn’t notice until their candidate won and did everything they thought they’d voted against. There was the Great Unemployment with thousands of laid-off applicants for jobs no one got, that only fulfilled a posting requirement. Saddest of all, young people continued to die until no one could pretend it was natural, and the same with disasters spreading like … um … wildfire.

What popped the soap bubble for good was the central bank digital currency. After the first rollout in Nigeria created so much chaos the President had to step down, they learned to create the chaos first so CBDC would be the solution. It didn’t go the way they planned.

Instead of runs on banks, the money evaporated in the banks. Any sense of money’s solidity was gone. Suddenly, everyone realized it was just an idea—an idea for which they were giving their lives away. The debt the banks issued as a mortgage—just a made-up notion in someone’s head. And for that notion, you worked for 30 years.

While money was ephemeral, houses were real. Why should they be given to central bankers for nothing? Communities could issue their own digital currency backed by the houses to supplement their local economy. To set their goals, they sent out the following Yes/ No questionnaire to long-term residents of the commonwealth, called commoners.

dear commoner,

Are you looking to:

on housing

Lower the cost of housing? Maintain and upgrade existing houses? Create neighborhood hubs for tool libraries, community gardens, cafes, book swaps? Make it possible for intergenerational or divorced families to live close by? Stabilize or lower property taxes? Enable people to live where they work and work where they live?

on education

Diversify learning options to better fit parent and student interests? Make education debt-free and lifelong? Enable edu-travel and sabbaticals in ’sibling cities’? Have a university that prioritizes your own qualified students? Become a magnet city for an educational specialty? Empower everyone to teach what they know and learn what they want?

on income

Raise the local income to meet the cost of housing? Increase independent businesses and livelihoods? Open up home restaurants and micro-businesses? Generate money for useful work that serves the community? Make enough in fewer hours, and have more time for family and friends? Allow parents to raise children and do meaningful work, without needing to choose?

on food & wellcare

Foster locally produced food? Increase low-cost options for alternative health? Reduce costs and increase alternatives for elder care? Lower the cost of high quality dental work? Eliminate the need for insurances? Have food security with 1-2 days/week on a farm co-op, including animal husbandry?

on savings

Eliminate and even reverse inflation? Save securely for retirement at a high interest rate? Protect Social Security and lower the qualifying age? Save enough so that you'll have an income, no matter how long you live? Never worry about fraud, theft, bankruptcies, scams or market declines? Create funds for home downpayments, education and home improvements?

on community

Repair and improve local infrastructure? Facilitate emergency preparedness in the neighborhood? Cross-train neighborhood protectors and health advocates? Reduce road congestion while keeping cars available? Determine your own laws in matters that don't concern other communities? Eliminate homelessness and mental health / economic migration?

the first five years

A commonwealth consists of a hamlet of 10-30K people and the eight contiguous hamlets on its border, totaling less than 300K people. Every commonwealth is unique to that hamlet so no one was on the border. The hamlet decides the rules to distribute the digital credit, called a caret, that is backed by local mortgages. It can be spent at the same rate throughout the commonwealth, and the hamlet accepts the carets of all other hamlets in the commonwealth.

The only common rules are that all carets be distributed equally to all commoners of the hamlet and no more can be distributed than is coming in as tax or debt or backed by the national currency at whatever exchange rate the hamlet determines. Every person is a commoner of somewhere, as a native or long-term resident, and no one is a commoner of more than one place at one time. No one who is not a commoner can vote on local issues or caret distribution.

When the hamlets had been determined and commoners had voted, each goal was put into the system after the way to accomplish it had been tested in a collaborative modeling game. Metrics were collected at the start, like the percentage of local home ownership, independent livelihoods and local food production. The amount of extraction by outsiders and corporations was also measured. Many people went to where they were born, including the homeless and students, so they could take part in the shaping of their hometown and benefit from the distributions and priority. It was seen as a time of building the future, a unique period in history. Others stayed put to be future commoners where they had chosen to live.

the results

On Housing:

Commoners who already owned homes refinanced at the 3% fixed rate offered in 2025 by the commonwealth banks. This lowered their cost of housing and increased their security. Speculative owners, who weren’t local or wanted to cash out and move, sold quickly before the rate went up and the pool of local buyers went down.

Long term residents were able to transfer their savings into carets, protecting them from theft, saving at a high rate of interest, and giving them greater purchasing power. While some still prefer the simplicity of renting, home ownership has become the norm for those who are settled where they want to live.

For impoverished areas, this has brought a revitalization, a gentrification without displacement. Those who live there have become the landed gentry, with a share of the collective mortgages coming back to them for home improvements. They’ve encouraged young people to come where they can spread out and raise a family. This has brought new life to neighborhoods, with cafes on practically every corner.

On Education:

This five years has been a time of settling into place. The educational model was four intensive years, followed by decades of work to pay the debt. The goal was to shift to a lifetime of learning, primarily at home, with sabbaticals of low-cost edu-travel.

The results have been mixed—disappointment from those eager to live away from home with people all their same age, to excitement over the possibilities. These five years have not included travel. They have included a monthly dividend for decentralized learning, encouraging non-traditional classes.

Standards were agreed between commonwealths that 12 hours of instruction and 12 hours of independent study would equal one unit. The university system had required 2400 hrs of instruction for a Bachelor’s degree, which came to 200 units. A certificate was 10 units, an Associate was 100, a Master’s was 300 and a Doctorate 400. What changed was the content, chosen by the student.

Over these five years, developers of curricula have flourished. Every hamlet seems to have six eccentric courses of study that connect to other people around the world. Through online content and contact, networks of like-minded programs have formed. Instead of being siphoned off by college towns and corporate agendas, young energy has fused a connection to old wisdom, which is also learning new tricks.

At the start of 2031, we anticipate a lively exchange of students, young and old, who’ve been preparing for five years. Some have learned new languages or culinary skills or dance styles. Some have read the same two dozen books. Some have written screenplays they’ll go to see performed. Some will work on farms or build a boat. This quintile we take back and repurpose the colleges and universities. Viva la differénce!

On Income:

The same amount that had been extracted from communities in mortgages now circulates supporting independent livelihoods. For a hamlet of 20K people, the equivalent of $2M per month ($100 per person) now generates new income for food producers. The same amount bolsters new business in wellcare, in education, and in home improvements. And that was only the starting point in 2025.

As carets (^) these have no income or sales tax, only Social Security that stays within the hamlet as the people’s pension. Therefore all of this ‘new’ money—that had gone to foreign bankers before—continues to recirculate again and again, generating more wealth in local self-reliance. At this point, anyone who chooses can work for themselves or in a community function and make enough to save for a house and raise a family.

On Food & WellCare:

One of the sweetest results of this shift has been the reconnection to nature for children and elders alike. One or two mornings a week, a shuttle transports members of the same block who want to participate in a free farm share. It takes them just outside of town where they work under the direction of experts trained in permaculture and animal husbandry.

Meanwhile, grandmothers, mothers and infants, and anyone else who chooses, stays in the farmhouse to make lunch. After a convivial feast with flowers and friendly conversations, they bring home a share of the harvest to their household and neighbors who aren’t able to participate.

Federal subsidies still exist but medical insurance is no longer mandated. Hamlets have a surplus of national currency, from those who transfer them into carets to pay mortgages. Many have voted to fully equipped health clinics that doctors and dentists can use if they don’t charge more than the set rate. People are responsible for their own decisions so there are no lawsuits allowed, over medical malpractice or food. It’s their own choice who to use, and their responsibility to do the research.

We also look forward, in this next quintile, to the first crop of graduates from our new schools in dentistry, homeopathy, Chinese medicine and other specialties. Our neighborhood health advocates and emergency techs have made it easier for families to care for their elderly at home or in nearby group homes. As we share information on alternative treatments and causes of degeneration, this will only get better.

On Savings

Along with CBDC, the primary impetus for US revolution was the default on Social Security. The result of the uprising was that the Federal government handed responsibility for Social Security to the hamlets, along with the exclusive right to issue credit backed by the properties within their borders. And they issued a federal credit representing the money owed for the Social Security Trust Fund to capitalize commonwealth banks on an equal per-capita basis.

No one much cared about those details, they just loved the results. Social Security was put back to 65 as the standard age of retirement, and retirement savings are stable at a 3.5% return. Fixed mortgage rates have reached their peak at 5%, at which they’ll always remain. So inflation, which had been induced by a volatile rate, is a thing of the past. In areas with a high cost of living, housing will gradually decline next quintile. In hamlets where money moves too slowly, incomes will gradually increase.

Every shire, consisting of nine neighborhoods, has its own bank where the tellers know everyone. Money is protected at all levels by safeguards, so there’s no reason to gamble in the stock market. They can build wealth and an inheritance for their children through straightforward savings. As a bonus, commoners can borrow from their own savings at 4%, while still getting 3.5% on the amount—so it’s like a half-percent loan while the principle stays on target for retirement.

On Community

At every level of the hamlet, shire and neighborhood, commoners are engaged in the happy discussion of how to spend free money. It’s already hard to remember there was a time when we borrowed money from banks for things we did ourselves. Now it’s become a challenge to see how little we need from the outside, and how much we can do on our own.

And politics has become a friendly debate over the dinner table. It’s no longer about personalities but about policies. Some of these are internal but others include foreign policy and global partnerships. The rules of lawmaking include ‘no proper nouns’ and ‘don’t do unto others,’ meaning that whatever we wouldn’t allow someone else to do here, we can’t be willing to do there.

This led many hamlets to decide that commoners occupying other countries militarily would have one year to return or lose their status as commoners permanently. In only made sense, since they’d never allow foreigners with guns into their own hamlet. The logic was encouraged by the BRICS countries who enacted a trade embargo against NATO countries, which was also a brisk stimulus to become self-reliant.

An organization called Commoners For Peace is negotiating with the BRICS to restore trade with non-militant commonwealths. It helps that hamlets send trained volunteers to help in disasters and rebuilding. And no dual citizenship practically evacuated Israel, especially when ICC arrest warrants made an Israeli passport a liability. The Democratic State of Palestine finally became a reality.

Looking back, we can’t imagine where we’d be if things had continued the way they were. The uncertainty of how to live one day to the next, the loneliness of no connection to those around us, the constant stress of every day life all seem like a bad dream. But now, we have woken up.

There’s been much talk about Biden’s $10K student loan forgiveness but student loans are just one symptom of the dysfunctional education system. This episode examines how to reinvent K-12 through university with self-driven curricula, edu-tourism, edu-travel and no debt. It uses the economic system of anarchy and federalism described in my book, How to Dismantle an Empire. It references The Student Loan Scam by Alan Michael Collinge, a TEDtalk by Sir Ken Robinson, a NY Times article by Nick Burns, and The Underground History of American Education by John Taylor Gatto.

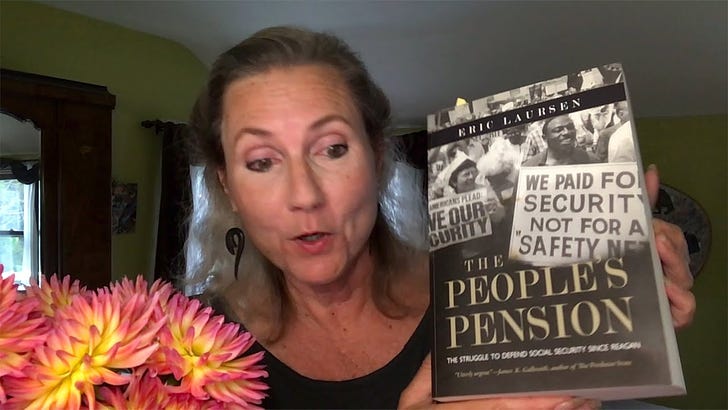

Continues the System Change Series developing a parallel community economy backed by local mortgages. This episode explores retirement and using the Social Security Trust Fund to capitalize public banks, stabilize the interest rate, and bring down the cost of the Unaffordable 4H--housing, healthcare, higher education and hope for retirement. Cites Eric Laursen's tome, The People's Pension. Explains how inflation is really dilution, what Ben Franklin thought was the right interest rate, and how we've been tricked into betting our futures on gambling chips.

Tereza I love that you have not only thoughtfully considered the 'how to' in dismantling an empire, but created a blueprint for what could come next. The practical steps and elements behind a vastly improved, human-centric, community-focused world.

"Any sense of money’s solidity was gone. Suddenly, everyone realized it was just an idea—an idea for which they were giving their lives away. "

Brilliant. Dead-on.

Your framing the conditions - in the not-too-distant future - is eerily plausible.

May this vision of what's possible and realistic permeate our world. I think a big challenge to taking the reigns back lies in a defeated populace that can't imagine what is actually, practically possible, and you are providing that blueprint.

Excellent.

My book group recently decided we will include non-fiction. I'm going to order the book (finally!) and after reading suggest it. I'll keep you posted on that.

Thank you for using your formidable mind to such good ends. Such a promising vision.

Best.

What you are talking about is Debt Free Money and any person who has introduced it has been assinssinated. It has been achieved twice Script Money in the USA , that lead to the War of Independence. In the UK it was the Bradbury Pound 1914 -1918 controlled by the Banksters.