This is Chapter 20 of How to Dismantle an Empire, from the final section, The Community Cash Cow. There is only one more chapter left and the conclusion, so we’re deep into the framework for a solution. These last chapters look at the steps that would take back our own labor for community sovereignty.

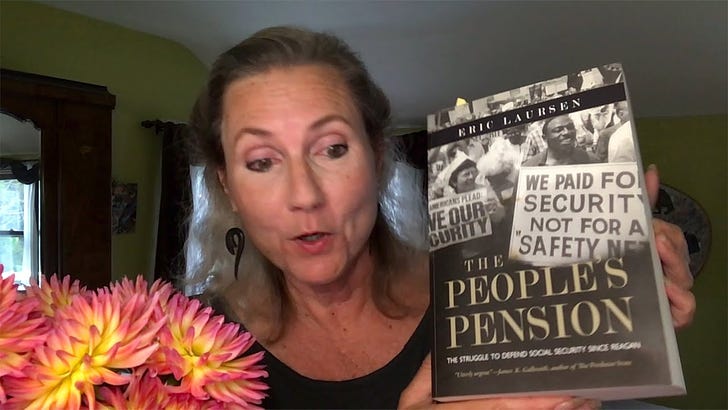

I start with the 1913 Sixteenth Amendment that gave the power of direct taxation to the ‘Federal’ gov’t. Eric Laursen’s tome, The People’s Pension, examines the history and brilliant design of Social Security. And it explains how we could use platinum coin seigniorage to replace the Trust Fund with non-debt money that could capitalize Commonwealth Reserve Banks where local credit and savings were backed by the mortgages.

The 16th Amendment gives the Federal government a direct claim on the lives of American citizens by enabling Congress to levy a direct income tax on individuals. Until the passage of the 16th amendment, the Supreme Court had consistently held that Congress had no power to impose an income tax.

Income taxes are responsible for the transformation of the Federal government from one of limited powers into a vast leviathan whose tentacles reach into almost every aspect of American life. Thanks to the income tax, today the Federal government routinely invades our privacy, and penalizes our every endeavor. The Founding Fathers realized that “the power to tax is the power to destroy,” which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

—RON PAUL, PROPOSAL OF THE LIBERTY

AMENDMENT TO CONGRESS, APRIL 30, 2009

Credit for Social Security’s survival ... goes to Franklin Delano Roosevelt and his New Deal advisors. Long dead, they continued to exert a powerful influence because of the ingeniousness of their creation, which combined personal savings, social insurance, and public assistance in a way that booby-trapped it for anyone hoping to dismantle it.

—ERIC LAURSEN, THE PEOPLE’S PENSIONTaking Back Taxation

In the Articles of Confederation, written after secession from England and before the shotgun wedding of the Constitution, the sovereign States held all powers of taxation. Local monetary policy was seen as the foundation of representative government, not voting for a proxy in a centralized fiscal system. The States did not want taxation used to control their internal commerce or to create funding for a standing army. They decided what and how to tax, and they held the proceeds in their own treasuries. It required a requisition by Congress to fund a Federal action, which the Representatives then had to get passed by their own Assemblies. This was considered inefficient by the military, by financiers of the military, and by real estate developers like George Washington who saw indigenous tribes as squatting on his God-given land.

The Constitution would not have passed if it had allowed the Federal Government to exercise direct taxation rather than requisitioning the States. Congress changed this with the Sixteenth Amendment in 1913, the same year they established the Federal Reserve.

Both Federal income tax and Social Security taxes, of course, go directly to the centralized government in Washington, DC, which runs on borrowed credit from the private bankers of the Federal Reserve with a debt ceiling they must constantly increase or have no funds. After the pandemic, States and local governments were left running on a shoestring with the small businesses on which they relied gone belly up. There’s never been a better opportunity to return the power of the pursestrings to the States or, even better, the commonwealths.

This chapter shows how we could grow small-scale economies alongside the current economy with new money not dependent on the “Federal” Reserve or “Federal” government by using the Social Security trust fund to capitalize Commonwealth Reserve Banks. This puts communities on an equal footing to restore their internal commerce and services: taking care of elders and children, producing food and upgrading infrastructure, rebuilding homes and reclaiming common lands. Everything they can do for themselves can be done without outside funding.

teeny-weeny socialism or capitalism at its best

Eric Laursen’s 700-page tome, The People’s Pension, traces the history of Social Security as it went from a national public insurance under President Roosevelt to a so-called “entitlement program” starting with President Reagan. Although it has endured decades of attack, if any tax can be said to unify liberals and conservatives, it would be Social Security. Laursen writes:

Social Security was the product of a long, difficult popular struggle, not the bipartisan, consensus-based politics that Washington likes to practice. Since 1980, each time it has been threatened with drastic cutbacks or privatization, grassroots coalitions of workers and retirees, with union labor, women, and people of color prominent among them, have turned out to oppose the changes.

Established in 1935 with the Social Security Act, one of its chief architects was Frances Perkins, the Labor Secretary and Chair of the Committee on Economic Security. In one meeting she was goaded by Senator Gore to admit there was “a teeny-weeny bit of socialism” in the program, but in fact it was a masterful blend of mutual aid and self-funding entrepreneurism, which broke the dependence on company pension plans or the government dole.

Contrary to a public welfare allotment, Social Security was designed as an earned benefit that workers paid into from the first dollar they made—originally at a rate of 2% of payroll up to a maximum of $3000. Roosevelt drew criticism that it was a regressive tax that extracted a greater percentage from the poor, but he replied, “we put those payroll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions and their unemployment benefits. With those taxes in there, no damn politician can ever scrap my social security program.”

a solemn compact

True to its self-funding charter, the program spent its first three years collecting a surplus before any benefits were paid out. What to do with this surplus was a dilemma: to withdraw so much money from circulation would plunge the economy back into the Depression from whence it was barely emerging. On the other hand, they neither wanted to hand the savings to Congress for relief programs nor to private equity firms for market speculation. In the end, they decided to keep the trust fund on loan to the government, but curtail the amount and use income tax to fill in the shortfall if need be.

Roosevelt’s 1944 State of the Union address proposed a second bill of rights with “adequate protection from the economic fears of old age, sickness, accident, and unemployment.” The reforms he set in motion to expand the program were fulfilled by his successor Truman whose 1950 Amendments added cost of living adjustments that kept pace with inflation.

Social Security changed the fate of the American family. In 1900 over 60% of aging parents had lived by necessity with their grown children but by 1975 this had dwindled to only 14%. Initially only 60% of the workforce, mostly white males, were covered by the insurance but through successive expansions it now includes 95% of workers. This has reduced poverty particularly among retired African-Americans from 60% to 29% and among women from 53% to 15%. Payments to families, under which 3 million children qualify, have narrowed the child poverty gap by 21%. It established “a solemn compact between generations, one that bound children more closely to parents” but without the latter becoming a millstone around the former’s necks.

the bulletproof plan

Social Security is a plan that makes sense for both individuals and the government. It’s a proportional tax in exchange for freedom from worry or the need to hoard an indeterminate amount for a worst-case scenario. It allows workers to plan for the future by having a base that they can supplement on a monthly basis or with a nest egg for emergencies. Social Security has been found to encourage individual savings. In studies, when people were told how much they’d need to retire, their first response was to give up. But when shown how much would be covered by Social Security, they took a practical approach to making up the difference.

Life insurance, euphemistically named, only pays out death benefits. However, social security truly is life insurance: a protection against outliving one’s savings. It frees the government, at no expense to itself, from providing charitable relief for the elderly, for widow(er)s and dependent children, or for the disabled. The government has even saved money by borrowing against the social security trust fund rather than from private investors. Also, it releases workers from finding a safe place to invest their savings without gambling in the stock market. They can invest by taking care of their parents’ generation and enabling their children’s generation to take care of them.

Social security is a predictable expense because the amount paid out is proportional to what’s paid in, it requires ten years to qualify, and payments are calculated by averaging the highest 35 years. It gives choice and flexibility to early or late retirees with fair incentives and penalties to manage their own risk and reward. Although the tax may be regressive, the benefits paid are progressive—those with lower incomes receive a higher percentage back even though those who were taxed on higher incomes receive a higher amount. Removing the income cap on taxable earnings without providing any additional return would change it from being a pension to being a welfare program, defeating Roosevelt’s intent in making it bulletproof.

For two-thirds of the elderly, social security makes up most of their income; nearly half would fall below the poverty line without it, as opposed to 9% currently. Yet this well-designed national pension plan isn’t given as favorable of terms as the private retirement vehicles called 401Ks. Under a 401K plan, income tax is deferred until the individual is at a lower rate after retirement. But under Social Security, only the employer half of the income tax is deductible—the employee-paid portion is not deductible from income tax and benefits. In a 401K plan, the investor can choose their risk and potential reward, either to keep their savings safe or gamble for a bigger return. But within Social Security, the government can lend the fund for a modest return or spend it at private discretion without ever being paid back: high-risk and low-reward, their choice, not yours.

“there Is no trust”

Is spending it all away really possible? Speaking to the Department of Commerce in 2005, President George W. Bush said:

Some in our country think that Social Security is a trust fund—in other words, there’s a pile of money being accumulated. That’s just simply not true. The money—payroll taxes going into the Social Security are spent. They’re spent on benefits and they’re spent on government programs. There is no trust. We’re on the ultimate pay-as-you-go system—what goes in comes out. And so, starting in 2018, what’s going in—what’s coming out is greater than what’s going in. It says we’ve got a problem. And we’d better start dealing with it now. The longer we wait, the harder it is to fix the problem.

Bush was speaking to a business-friendly crowd whose stated goal was to eliminate class-action lawsuits at the state level because “a litigious society is one that makes it difficult for capital to flow freely.” In this environment, Bush could candidly admit that the $2.7 trillion surplus wasn’t there. Where did it go?

A blogger with the moniker Dog Gone points out that deficit spending began with George H.W. but that Clinton managed to deliver a surplus to “the Shrub,” as he terms Bush Jr., whose war spending and tax cuts dealt a double whammy to the budget. Although both Democrats and Republicans handed out tax rebates, the Democrats gave more for income levels up to $200,000 while Republicans gave those with incomes between $500,000 and a million 2.6 times more tax breaks, and those with incomes over a million 16 times more.

dog gone it

At the Chamber of Commerce meeting, George W. stated that, with so many baby-boomers coming of age, all solutions were on the table except raising the payroll tax. This elicited applause from the audience, no doubt thinking about the employer-paid portion.

Dog Gone, however, asserts that even though the trust is gone, the trust fund is still owed because the baby-boomers have kept up their end of the bargain. He quotes economist Allan W. Smith, author of The Big Lie, The Looting of Social Security, and The Impending Crisis of Social Security, saying, “The baby boomers have contributed more to Social Security than any other generation. They have prepaid the cost of their own retirement, in addition to paying the cost of the generation that preceded them.”

The baby-boomer card was already played by a young Alan Greenspan. His commission used this rationale to back the Social Security Reform Act of 1983, which President Reagan signed into law. Remembered for the tax cuts he campaigned on, Reagan actually raised taxes more than any other peacetime President for the majority of people. In 1980 middle-income families paid 8.2% in income tax and 9.5% in payroll tax for a combined 17.7%. By 1988 their income tax was down to 6.6% but the payroll tax was up to 11.8% for a combined 18.4%. This merely shifted the tax burden downward and created a slush fund: both income and payroll taxes go into the General Fund but, by law, no budget can take money out of the latter. In effect, therefore, this gave the surplus to the administration to borrow against without the oversight or approval of any other body.

Two decades later, Alan Greenspan was playing the same card in calling for cuts to benefits because “We are overcommitted at this stage. It’s important that we tell the people who are about to retire what it is that they will have.” There was no mention of the $2.7 trillion surplus his 1983 Commission established through the boomers with higher taxes and an automatic raising of the taxable-income cap. In April of 2005, Bush reiterated to students at West Virginia University, “There is no trust fund, just IOUs that I saw firsthand that future generations will pay—will pay for either in higher taxes, or reduced benefits, or cuts to other critical government programs.” Both our trust and our trust fund look to have been misplaced in the DC government.

golden eggs forever or foie gras?

Social Security is the goose that lays the golden nest egg for government. Since its increase to 12.4% (with the exception of 2011 and 2012 when President Obama lowered it) Old-Age, Survivors, and Disability Insurance, or OASDI, has run a surplus that goes back into the Trust Fund, which had been expected to peak at $2.9 trillion in 2020 (before a 2017 bill allowed disability, whose trust fund was exhausted, to tap it). These surplus dollars are exchanged for “special-issue” Treasury bonds that are redeemable at face value. In 2012 they returned an interest rate of less than 1.5%, although market-rate investments for earlier years gave the total fund an effective return of 4%. At its inception, the government had promised at least 3% interest for the privilege of borrowing the surplus from the General Fund.

The higher-interest T-bills are expiring, however, while cost of living adjustments (COLAs) are using up the tax revenue and tapping into the interest income that’s no longer rolled over into the trust. Republicans spin this as “running a deficit” although payments draw on the interest but not the principal. By 2020, when the boomer generation begins to retire and there are fewer workers paying in, the principal will need to be drawn down to pay out benefits. In 2008 the statements sent out by Social Security warned that the trust fund would be depleted by 2041, which they revised the next year to 2037. Now, due to depletion by the Disability fund, it’s down to 2034. At that point, Social Security will only be able to pay out 77% of its promised retirement benefits.

The annual report by the trustees recommends that Social Security could be kept solvent (not needing to be supplemented by the trust fund) through a combination of raising the tax rate from 12.4% to 15%, reducing all current and future benefits by 16.5%, or keeping current beneficiaries the same but reducing future beneficiaries by 20%. Others have recommended raising or eliminating the income cap on which social security is charged but keeping the maximum benefit the same—or eliminating benefits altogether for those who make over a certain income.

However, this would defeat Roosevelt’s purpose in making Social Security a pension plan, not a welfare system for the poor that depends on contributions from the rich. There needs to be a better way.

trust fund: boon or bust

Storing a large sum of money like the trust fund is more difficult than it seems. The funds can’t be put away in a virtual lock-box without crashing the economy by taking so much out of circulation. They can’t be spent and replenished as needed without imposing new taxes. And they can’t be invested so that they’ll keep pace with inflation because the safe functions of money—capitalization, currency creation, and mortgage investment—have been given over to privately owned banks.

Of the $2.5 trillion in capital held by the Federal Reserve in 2014, 95% was in excess of the bank’s reserve requirements. It makes up the bulk of the monetary base (MB) that totals $3.7 trillion once the $1.2 trillion of dollars and coins in circulation (M1) are added in. Therefore, if the $2.7 trillion Social Security trust fund capitalized a network of Commonwealth Reserve Banks, they would be just as stable and robust as the banker-owned Federal Reserve.

By creating mortgage loans through Commonwealth Reserve Banks at a multiple of its $2.7 trillion in capital, the government could spend the interest back into the economy—guaranteeing that there would be enough in circulation at all times to repay both debt and interest. Ten times the $2.7 trillion in capital would create $27 trillion in loans. At five percent interest, this would return $1.35 trillion to local governments annually, or a 50% return on the Social Security trust fund. In 2012 benefit payments for social security, survivor benefits, and disability insurance totaled $775 billion. The $1.35 trillion in interest could fund all of it with $565 billion leftover.

However Social Security is mostly self-funding through recirculation of the collected tax. If payroll taxes were automatically deposited in the government’s account at the Commonwealth Reserve Bank (serving 100,000 to 300,000 people), they could give the trust fund a whopping 7% return and it would be solvent for the foreseeable future. The rest would fund the community.

the war on housewives

A lot has changed since World War II but Social Security’s division of income isn’t one of them. The war was the first time that women en masse started doing a man’s work of earning income. Since then, much has been written about pay discrimination for a woman who’s doing a man’s job in a man’s world. But, like competition for housing, once the market absorbed the double labor of the two-income family, it became an obligation rather than a choice. For Social Security, the unpaid labor of women’s work earns them half as much retirement security as their income-earning spouses, and no ability to increase it by choosing to collect at 70. For those whose labor serves families and communities, they’re seen by the DC government as already retired.

If Social Security taxes were collected and controlled at the level of the Commonwealth, they could be brought in line with the divorce laws of more family-friendly States that say both spouses contributed equally to a marriage no matter how they divided their labor. Social Security could be, like pensions, split in a divorce rather than requiring lifelong alimony payments. And those with State pensions instead of Social Security, such as teachers, would no longer face the double-whammy of losing half of their pensions with no equalization of Social Security in return.

the three-trillion dollar coin

If what President Bush said is true, there is no trust, just a pile of IOUs from the US people to the US people. So how could this nonexistent trust fund be used to capitalize Commonwealth Reserve Banks? If the government had to borrow the trust fund from foreign investors or the US banking cartel of the Federal Reserve to give to the States, it would defeat the purpose.

Section 8 of the Constitution gives Congress the right “to coin Money, regulate the Value thereof, and of foreign Coin...” Although interpreted to not include dollar bills or virtual credit, it leaves a loophole. The right of seigniorage comes from the Middle Ages and is the lord’s privilege to mint money with a face value higher than its bullion value. A 1996 law transferred the seigniorage specific to platinum coins from Congress to the Secretary of the Treasury:

The Secretary may mint and issue bullion and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

During the first fiscal cliff crisis of 2009 a blogger called beowulf brought up the idea of using a trillion-dollar platinum coin to get around the Republican intransigence over raising the debt ceiling. It could be deposited in the Mint’s Public Enterprise Fund account at the Federal Reserve. The Fed must, by law, credit the account with the face value of the coin, which is swept into the general spending account of the Treasury. This would erase one trillion in debt to the Federal Reserve in one fell swoop, creating more room before the ceiling was reached again.

beowulf whelps a movement

The former director of the US Mint, Philip Diehl, who drafted the platinum coin law, confirmed its applicability:

When I first heard about the idea to mint a trillion-dollar coin, I was very surprised. But because I know that law backwards and forwards, I knew immediately that the guy who came up with the idea was right. It’s an ingenious use of the law to avoid a ridiculous and irresponsible situation, in which the country would be driven to default.

In 2013 the idea gained traction with endorsement from Nobel Prize-winning economist Paul Krugman, who saw it as a silly but potentially effective gambit to force Congress to raise the debt ceiling, which he still saw as the preferred option. He wrote:

So minting the coin would be undignified, but so what? At the same time, it would be economically harmless—and would both avoid catastrophic economic developments and help head off government by blackmail.

Blogger Joe Firestone took the idea further by proposing High Value Platinum Coin Seigniorage at $30 trillion or more. This would allow Congress to spend whatever it needed domestically to create full employment, low inflation, and sustainable economic prosperity according to the principles of Modern Monetary Theory, while paying more attention to our deficit to other countries. Both Firestone and beowulf credit Ellen Brown with introducing the possibility in her book Web of Debt, first published in 2007 and now in its fifth edition.

To transfer the Social Security trust fund from a debt owed to private bankers into government-issued money, three one-trillion dollar coins could be produced and held at the US Mint. Perhaps one would have the face of Frances Perkins on one side and the words of Franklin Delano Roosevelt on the other: “True economic freedom cannot exist without economic security and independence. People who are hungry ... are the stuff of which dictatorships are made.” With these coins the government would own the Social Security trust fund. The existing investments would be phased out as they came due, creating no new money.

the restart button

Or perhaps the funds “borrowed” by DC wouldn’t need to be paid back by future taxes and could be erased as a debt from the government to the people. That would be an incentive for them to allow the regenerated trust fund to be the monetary base for a sovereign currency, instead of the $2.5 trillion currently held by the Federal Reserve. The DC government would also be released from the burden of future liability for Social Security payments. Three one-trillion dollar coins could buy back all of the nation’s mortgages. It would be like pushing the restart button on a new economy. Let’s see how it would look:

The credit from the $3 trillion coin, divided equally among all people in the US, amounts to $9000 per person.

Banks can loan out ten times their capital reserves. With $23,400 in capital per household ($9000 * 2.6 people), public banks could loan an average of $234,000 per household.

In 2012 the average new mortgage was $235,000.

The Social Security Trust Fund could enable the transfer of every mortgage in the country to Commonwealth Reserve Banks.

If the ability to “print money” by lending was withdrawn from private banks, this would have no impact on dollars: neither taking them out of circulation nor putting them in. The interest payments could finance Social Security indefinitely, enabling full benefits at 65 once again, and create a cash flow that would revitalize and relocalize social services: education, public welfare, infrastructure, healthcare, police, fire, emergency, and elder care. It could buy out government loans that are covered by interest-rate swaps and replace them with fixed low-interest loans. It would protect communities from usurious fees, forced austerity measures, attachment of community assets, or the raiding of pension funds. The building of the commonwealth could start again.

CHAPTER 20 EXERCISES

Using examples from the book, or from your own research, logic, and experience, comment on the following and what it means today:

Paradigm Shift #20

Social Security is not a welfare program but a brilliantly designed national pension plan. The retirement savings of past generations are the bedrock on which to build the future security of communities, measured not in money but in the wealth of self-reliance.

The “Federal” government has no legal right to issue money other than coins. However, they can assign those coins any value they want and issue credit against them. This credit could become the monetary base of Commonwealth Reserve Banks, replacing the banker-owned “Federal Reserve.”

LEXICON

Explain how the following definitions change the dialogue around social problems. Is this concept used in discussion of the examples to which it applies? If not, how does this affect the potential solutions?

Social Security: a program developed by Frances Perkins under FDR to self-fund pensions for workers and provide an income for widows and orphans, reducing poverty and the burden on government.

Social Security trust fund: the accumulated public savings that have grown from the inception of the program in 1935, predicted to reach almost three trillion dollars in 2020.

401K plan: private retirement savings given tax-deferred status, unlike Social Security, and invested in the market.

payroll taxes or OASDI: automatic deductions taken before paychecks are issued for Old-Age, Survivors, and Disability Insurance, usually called Social Security. The half paid by employers is tax-deductible.

cost of living adjustments (COLAs): increases to Social Security benefits due to “inflation” or the diluted value of the dollar in proportion to the goods and services produced.

seigniorage: the privilege of the lord to mint coins and assign them a face value higher than the trade value of their metal bullion.

fractional reserve banking: the ability of banks, authorized by the Federal Reserve, to issue debt at a ratio of 10 to 1 to their capital and deposits.

QUESTIONS FOR REFLECTION AND DISCUSSION

Comment on the design of Social Security by Frances Perkins and FDR. What do you like about it and what would you have done differently? How would you restructure it within your own commonwealth, if you would? Would you offer a high rate of return to government pension programs, such as teacher unions, if they deposit their trust funds? What about corporate pension plans? Could individuals protect retirement savings by depositing them in the Commonwealth Bank at a higher rate of return? Is there a way to equalize or even advantage the return for parents without raising their joined maximum?

In your commonwealth, would you withdraw the privilege of creating credit from private banks? What form of backlash could you foresee? Are there steps you could take to buffer against this backlash?

Continues the System Change Series developing a parallel community economy backed by local mortgages. This episode explores retirement and using the Social Security Trust Fund to capitalize public banks, stabilize the interest rate, and bring down the cost of the Unaffordable 4H—housing, healthcare, higher education and hope for retirement. Cites Eric Laursen’s tome, The People’s Pension. Explains how inflation is really dilution, what Ben Franklin thought was the right interest rate, and how we’ve been tricked into betting our futures on gambling chips.

Explains why inflation is really dilution and your house is not worth more, your money is worth less. Gives examples from my book, How to Dismantle an Empire, on how the interest rate affects the price of a house and how they fluctuate it for the bankers’ benefit. Cites Ellen Brown and Matt Ehret on bail-ins and reads passages from my book on how the bond rating sunk Cyprus. Begins with dramatic and personal illustrations of inflation—the hospital bill when I was born and my college scholarship.

China's central bank is government owned. It creates the Chinese domestic currency the yuan

(also called the renminbe) free of debt, as required to fund Chinese government expenditure to pay its workforce to create public services such as infrastructure, bridges, railways, tunnels. power stations, education, healthcare, state pensions, research and development and the military. The Chinese government has no debt, it can actually create more money by taxing Chinese private corporations that would control the rate of inflation of the currency.

I'm sure glad you're examining all of this Tereza!

I don't understand it, but I sure like the cut of your jib lol.

Seriously, nice work dissecting it.